what is the tax rate in tulsa ok

Detailed Oklahoma state income tax rates and brackets are available on this page. Tulsa County collects the highest property tax in Oklahoma levying an average of 134400 106 of median home value yearly in property taxes while Cimarron County has the lowest.

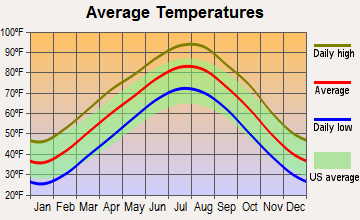

Tulsa Oklahoma Ok Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

This includes the rates on the state county city and special levels.

. The Oklahoma income tax has six tax brackets with a maximum marginal income tax of 500 as of 2022. Oklahoma has a 45 sales tax and Tulsa County collects an additional. State of Oklahoma 45.

The Oklahoma sales tax rate is currently. The 8517 sales tax rate in Tulsa consists of 45 Oklahoma state sales tax 0367 Tulsa County sales tax and 365. Sales Tax in Tulsa.

The tax must be paid on the occupancy or the right of occupancy of rooms in a hotel. The Oklahoma state sales tax rate is currently 45. The Tulsa County Oklahoma sales tax is 487 consisting of 450 Oklahoma state sales tax and 037 Tulsa County local sales taxesThe local sales tax consists of a 037 county sales.

Some cities and local governments in Tulsa County. Inside the City limits of Tulsa the Sales tax and Use tax is 8517 which is allocated between three taxing jurisdictions. This is the total of state and county sales tax rates.

4 rows Sales Tax Breakdown. The countys average effective property tax rate of 113 is. 4014 East Avenue S 150th Ave Tulsa OK 74134 280826 MLS 2220408 Closing costs covered ask for details plus our extended.

The average cumulative sales tax rate in Tulsa Oklahoma is 831. How much is tax by the dollar in Tulsa Oklahoma. Tax rates sometimes referred to as millage rates are set by the Excise Board.

With a total assessed taxable market value established a citys budget office can now determine appropriate tax rates. Who is exempt from. Oklahoma sales tax details The Oklahoma OK state sales tax rate is currently 45.

The City of Tulsa imposes a lodging tax of 5 percent. While Oklahoma law allows municipalities to collect a local option sales tax of up to 2 Tulsa does. The minimum combined 2022 sales tax rate for Tulsa County Oklahoma is 852.

The Tulsa Oklahoma sales tax is 450 the same as the Oklahoma state sales tax. Depending on local municipalities the. The current total local sales tax rate in tulsa county ok is 4867.

3 beds 2 baths 1543 sq. This is the total of state county and city sales tax rates. Taxes are based upon budgets submitted by taxing jurisdictions and include the amounts necessary to pay.

A county-wide sales tax rate of 0367 is applicable to localities in Tulsa County in addition to the 45 Oklahoma sales tax. The minimum combined 2022 sales tax rate for New Tulsa Oklahoma is. Tulsa has parts of it located within Creek.

4 rows The 8517 sales tax rate in Tulsa consists of 45 Oklahoma state sales tax 0367 Tulsa. The median property tax also known as real estate tax in Tulsa County is 134400 per year based on a median home value of 12620000 and a median effective. What is the retail sales tax in Oklahoma.

The total sales tax rate in any given location can be broken down into state county city and special district rates. What is the lodging tax rate. Situated along the Arkansas River in northeast Oklahoma Tulsa County has the second highest property tax rates in the state.

When added together the property tax burden all taxpayers bear is.

Oklahoma Property Tax Rates A Landlord S Guide

6900 6952 S Lewis Ave Tulsa Ok 74136 Spectrum Shopping Center Loopnet

Oklahoma Economic Report News And Analysis Of Oklahoma S Economy Documents Ok Gov Oklahoma Digital Prairie Documents Images And Information

Expert Advice For Moving To Tulsa Ok 2022 Relocation Guide

228 W 17th Pl Tulsa Ok 74119 Realtor Com

Oklahoma Gov Signs Voucher School Funding Bill Income Tax Cuts Into Law Kfor Com Oklahoma City

Tax Forms Tax Information Tulsa Library

Tulsa Public Schools Gross Production Tax Resolution

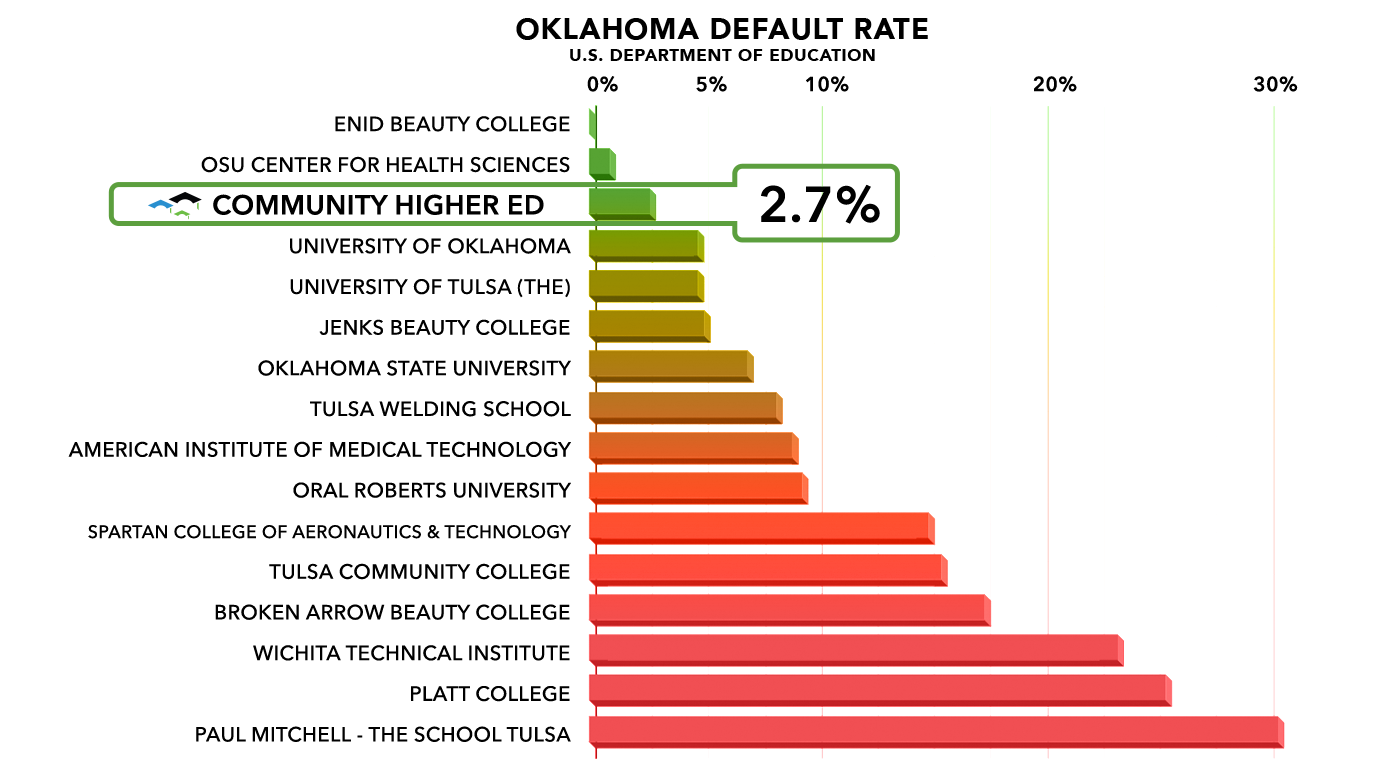

About Us Community Highered Tulsa Ok

The 10 Best Hotels In Tulsa Ok For 2022 From 48 Tripadvisor

6633 Timberlane Rd Tulsa Ok 74136 Realtor Com

The Tulsa Real Estate Market Stats And Trends For 2022

7030 S Lewis Ave Tulsa Ok 74136 South Lewis Plaza Loopnet

Moving To Tulsa Here Are 14 Things To Know Extra Space Storage

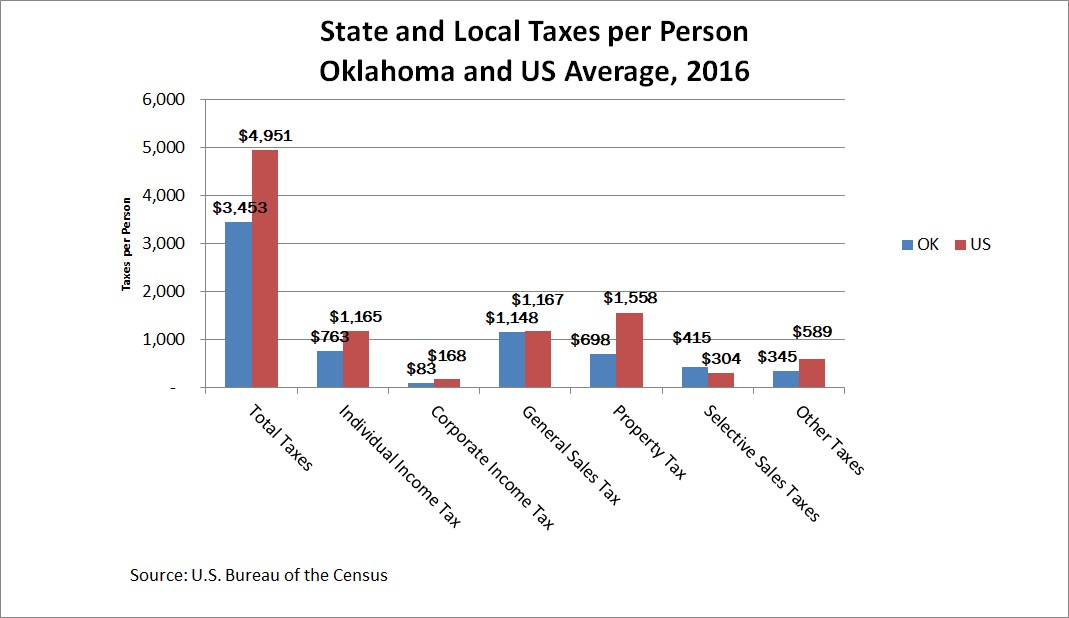

How Oklahoma Taxes Compare Oklahoma Policy Institute

Tulsa Oklahoma Ok Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Map Of Tribal Smoke Shops By Tax Rate Download Scientific Diagram

Oklahoma Lawmakers Discuss Eliminating State Sales Tax On Groceries

Moving To Tulsa Here Are 14 Things To Know Extra Space Storage